How Do Banks Catch Money Laundering

This occurs when the money launderers themselves own or run the financial institution. TCF uses due diligence tools like Thomson Reuters CLEAR to better link accounts with potential alerts or money laundering patterns.

How Money Laundering Works Howstuffworks

Covering transactions between 1999 and 2017 the SARs were leaked from the US Financial Crimes Investigation Network FinCEN an agency.

How do banks catch money laundering. Criminal organizations try to launder the money to use the crime earnings they get from crimes. Layering may consist of several bank-to-bank transfers. The IMF and UNODC estimate that 21 trillion is laundered by criminals each year and the techniques used to launder dirty money are becoming more and more sophisti How do banks detect money laundering Telleyz.

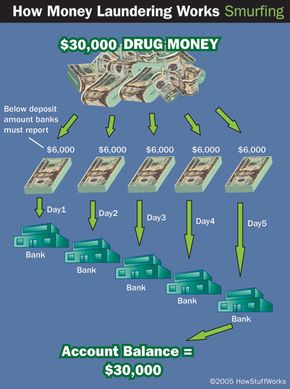

And purchasing high-value items boats houses cars diamonds to change the form of the money. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. If suspicious activity is detected the alert will make its way to the banks anti-money laundering department for analysis.

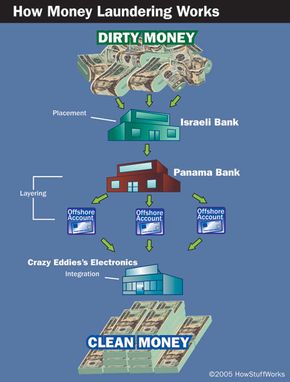

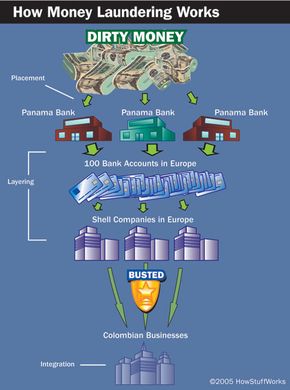

The first step is placementthis is the point where dirty money first enters the financial systemLayering then hides the source of the money using various bookkeeping tricks. Finding individuals with multiple PINs or with connections to tax fraud are among the many factors that could trigger further investigations. But banks face a catch-22 situation with the responsibility to report activity and help law enforcement investigate the criminals behind money laundering activities but risk of fines if they let.

The risk to the money launderer is that one of these parties will abscond with the cash so hefty fees or commissions are allowed as money shifts through the various entities that are laundering money. Cash is deposited in bank accounts. Placement in financial institution.

Effect on money demand It occurs more frequently in countries where the risk of money laundering is minimal. According to the announced data criminals carry out 97 of money laundering activities through financial institutions. Wire transfers between different accounts in different names in different countries.

And once the source of the money has been successfully disguised comes the last stepintegration when clean money can be withdrawn or. The IMF and UNODC estimate that 21 trillion is laundered by criminals each year and the techniques used to launder dirty money are becoming more and more. Structuring is the most common reason Suspicious Activity Reports SARs are filed by banks but its also the most direct way to get money into a US.

Money laundering typically follows a basic three-step process. Changing the moneys currency. Making deposits and withdrawals to continually vary the amount of money in the accounts.

The client or potential client may show some type of criminal activity through negative media or their account may exhibit behavior that may be suspicious. In economies where there are no regulations on laundering where there is a system that stores bank or customer information where banking secrecy is strictly enforced the informal economy ratio to the national economy is high. The basic steps in a money laundering scheme are as follows.

All banks have Anti-Money Laundering AML systems in place but they are crippled by a variety of different inefficiencies that are allowing criminal activity to remain undetected. Laundered money is known to be funding illegal activities including terrorism which places banks under immense pressure to identify the source of such funds. FinCENgov Financial Action Task Force FATF.

In this case the money can move throughout the bank and is legally transferable to other banks. Considering that banks mediate millions of financial transactions during the day banks are at great risk for financial crimes. Because the money moves without investigation this form of laundering can be difficult to catch.

To push the odds in their favor drug traffickers hire a veritable army of people to deposit small amounts of cash in banks all over the country in cities large and small.

How Money Laundering Works Howstuffworks

Why Five Dutch Banks Are Teaming Up To Counter Money Laundering Arachnys

Anti Money Laundering Archives Corruption Crime Compliance

How Money Laundering Works Howstuffworks

Money Laundering Ring Around The White Collar

Podcast How Banks Detect Money Laundering

Cleaning Up Money Laundering Brink Conversations And Insights On Global Business

How Money Laundering Works Howstuffworks

Money Laundering Overview How It Works Example

Money Laundering How Do Banks Detect Criminal Activity N26

5 Methods That Modern Money Launderers Use To Beat Detection Tookitaki Tookitaki

Podcast How Banks Detect Money Laundering

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Anti Money Laundering Overview Process And History

How Money Laundering Works Howstuffworks

10 Red Flags To Detect Money Laundering In The Finance Sector

Coinsecure Exchange Reveals Compensation Plan With A Catch Cash Loans Online Currency Market Instant Cash Loans

Network Analytics And The Fight Against Money Laundering Mckinsey Company

Post a Comment for "How Do Banks Catch Money Laundering"