Money Laundering Countries High Risk

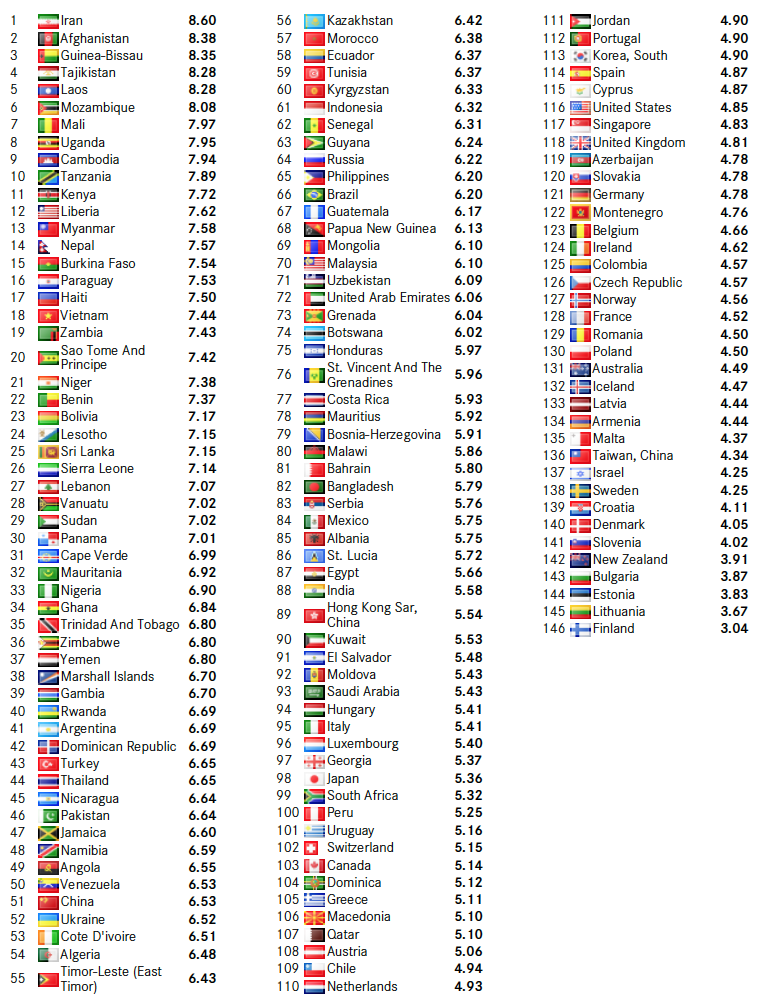

The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. Methodology for identifying high-risk third countries.

The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Money laundering countries high risk. For example where clients have. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. The 23 jurisdictions are.

Some of the countries listed today are already on the current EU list which includes 16 countries. Or the degree of its cooperation in the international fight against money laundering. Albania Barbados Botswana Burkina Faso Cambodia Cayman Islands Democratic Peoples Republic of Korea DPRK Haiti Iran Jamaica Malta Mauritius Morocco Myanmar Nicaragua Pakistan Panama Philippines Senegal South Sudan Syria Uganda Yemen and Zimbabwe.

The Commission proposes also today to de-list a number of countries. As of October 2018 the FATF has reviewed over 80 countries and publicly identified 68 of them. It must also be carried out in certain prescribed situations.

New delegated act on high-risk third countries. High-risk countries and regions Customers from any of these places and transactions to or from these places require careful monitoring. EU list of high-risk third countries.

Any references to high-risk third countries within the Guidance are therefore to be interpreted accordingly. Fourth Anti-Money Laundering Directive. Haiti Malta Philippines and South Sudan are each newly defined as a high-risk third country.

A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk score. Of these 68 55 have since made the necessary reforms to address their AMLCFT weaknesses and have been removed from the process see also an overview of. Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen.

For financial institutions operating in countries that are members of the FATF financial relationships with high-risk countries could result in legal action. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 introduces this list in Schedule 3ZA which replaces the previous definition in Regulation 333a. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021.

Enhanced customer due diligence and monitoring EDD is required by the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 in any situation where there is a higher risk of money laundering or terrorist financing. Background and current high risk countries As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 will come into force on the 26 March 2021 and will amend the definition of a high risk.

You should have risk-based systems and controls in place for. It is not based on an assessment of the country or jurisdictions legal framework to combat money laundering. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering.

By combining these various data sources the overall risk score represents a holistic assessment. Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD.

Which countries does the Commission propose to list on the new EU list of high-risk third countries. Identification as a major money laundering country is based on whether the country or jurisdictions financial institutions engage in transactions involving significant amounts of proceeds from serious crime. The Commissions new list includes 12 countries listed by the Financial Action Task Force as well as an additional 11 jurisdictions.

Geographies where money laundering or terrorist financing risk is high. Institutions for example are prohibited entirely from engaging in financial transactions with North Korea under the North Korea Sanctions program Section 311 of the USA PATRIOT Act and several Executive Orders. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries.

Fifth Anti-Money Laundering Directive. As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing. Its role in the terrorism financing problem.

The new Schedule 3ZA lists the following countries for the purposes of enhanced customer due diligence requirements. The 24 high-risk third countries are.

Global Money Laundering Risk Index Rises With Iran Rated Worst And Finland Least Risky Ctmfile

Aml For The Art And Finance Industry Deloitte Luxembourg Solutions Art Finance

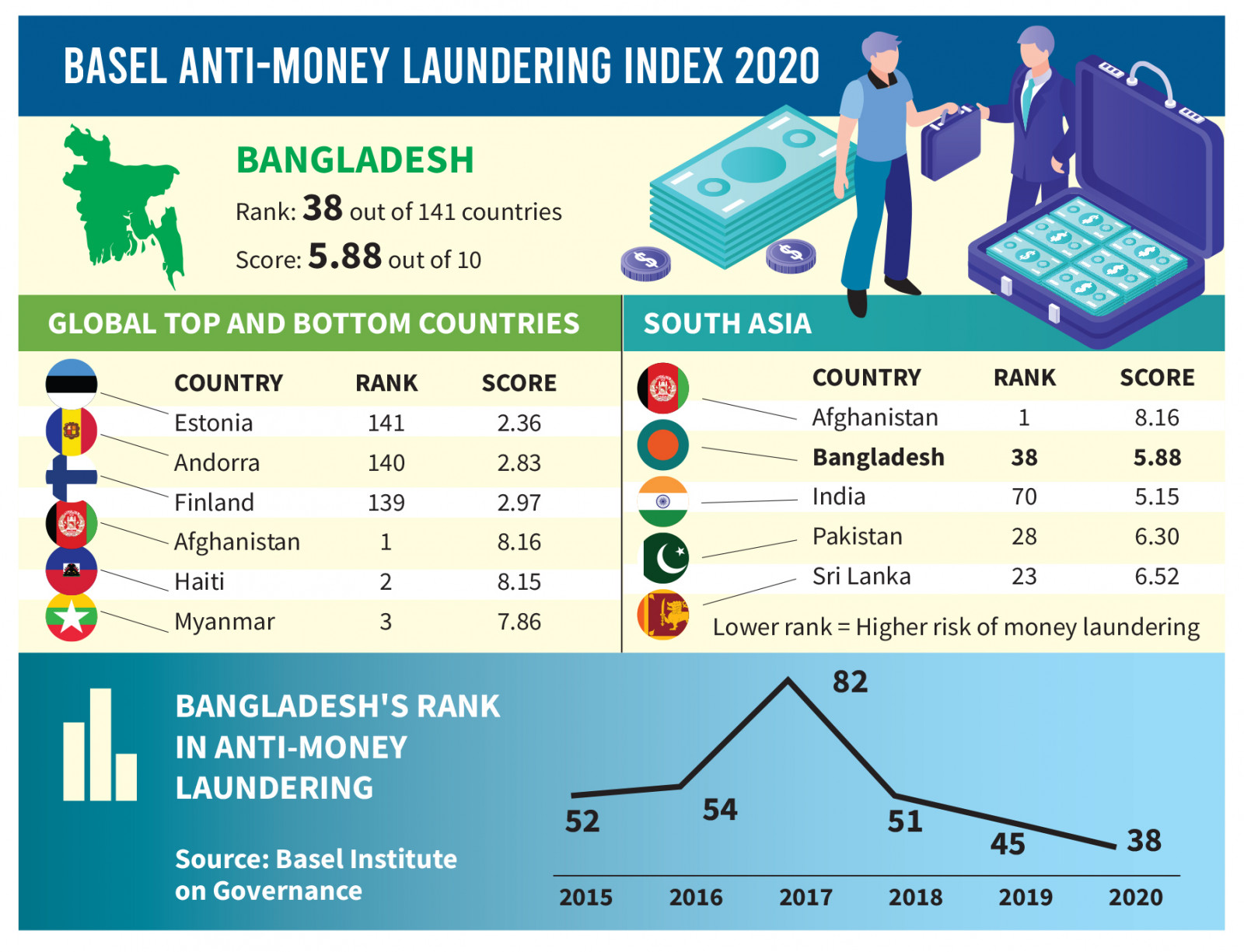

Money Laundering Risk Increases In Bangladesh

Major Money Laundering Countries Sanction Scanner

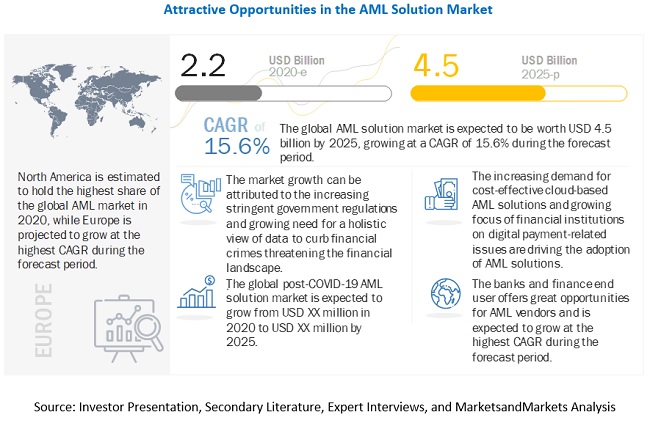

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

Methodology And Data Basel Institute On Governance

Combatting Money Laundering And Terrorist Financing Government Se

The Symbol Of Offshore Investments Financial Crimes And Money Laundering Money Laundering Notes Online Photo

Eu Policy On High Risk Third Countries European Commission

Basel Anti Money Laundering Index

Anti Money Laundering Programmes Systems Financetrainingcourse Com

Nordea In Money Laundering Scandal After Calling Bitcoin High Risk For Money Laundering Money Laundering Bitcoin Cryptocurrency

Documents Financial Action Task Force Fatf

Risk Assessment Support For Money Laundering Terrorist Financing

Post a Comment for "Money Laundering Countries High Risk"